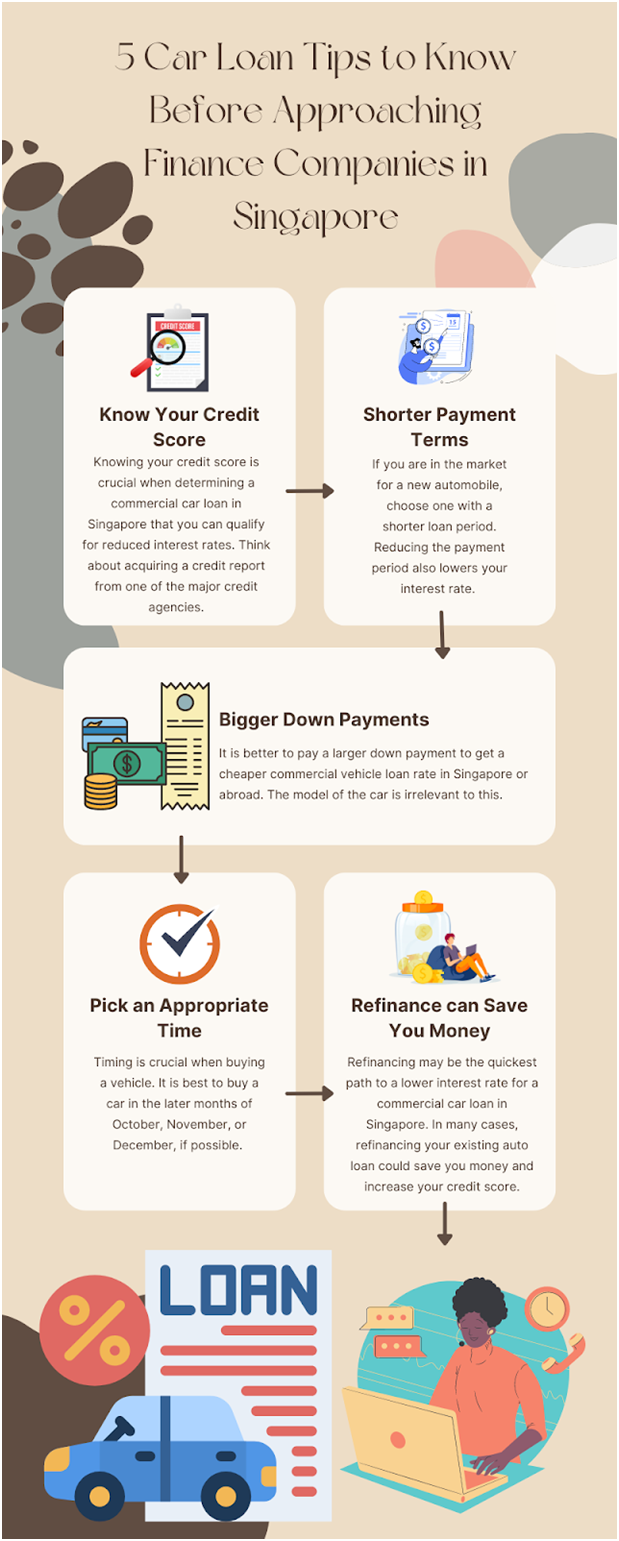

You are probably considering getting an auto loan from finance companies in Singapore if you plan to buy a vehicle for business purposes. Here are five crucial auto loan tips to help you determine a financing option suitable for your circumstances.

#1 Know Your Credit Score

Knowing your credit score is crucial when determining a commercial car loan in Singapore that you can qualify for reduced interest rates. Think about acquiring a credit report from one of the major credit agencies.

#2 Shorter Payment Terms

If you are in the market for a new automobile, choose one with a shorter loan period. Reducing the payment period also lowers your interest rate. You will save money by paying less for your vehicle altogether.

#3 Bigger Down Payments

It is better to pay a larger down payment to get a cheaper commercial vehicle loan rate in Singapore or abroad. The model of the car is irrelevant to this. Strive to put down at least 20{c9fa8a51a37b94dde3b9cbec863071c45875e1df1948056f154d2cb6c8d4f3d1} of the total cost.

#4 Pick an Appropriate Time

Timing is crucial when buying a vehicle. It is best to buy a car in the later months of October, November, or December, if possible. Also, sales representatives are under pressure to reach their quotas later in the month and earlier in the week. They will be more likely to negotiate the price with you, a beneficial move for any commercial car loan in Singapore.

#5 Refinance can Save You Money

Refinancing may be the quickest path to a lower interest rate for a commercial car loan in Singapore. In many cases, refinancing your existing auto loan could save you money and increase your credit score.

Swee Seng can provide an in house car loan to individuals in Singapore at 2.98{c9fa8a51a37b94dde3b9cbec863071c45875e1df1948056f154d2cb6c8d4f3d1} interest. They also offer straightforward and painless COE renewal financing to consumers. Explore their website to learn more about the firm, offers and services.